Gold continues to trade just under $2,500 an ounce after surging past the psychologically important level for the first time ever in mid-August. For seasoned gold mining investors, this should be a moment of validation. After all, the yellow metal has long been seen as the ultimate hedge against economic uncertainty.

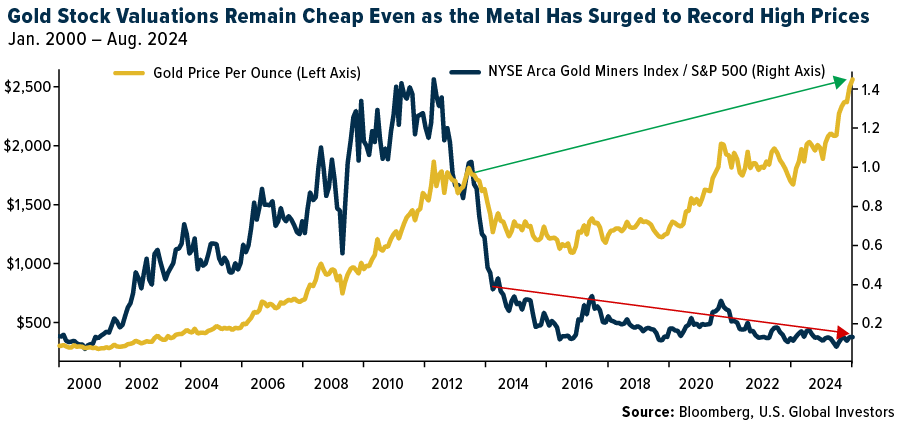

And yet, despite the bull run, gold stocks—those companies that mine, process and sell the metal—are trading at historically low valuations relative to the market.

We believe this disconnect offers contrarian investors an attractive opportunity.

Rising Yields and the Gold Selloff Explained

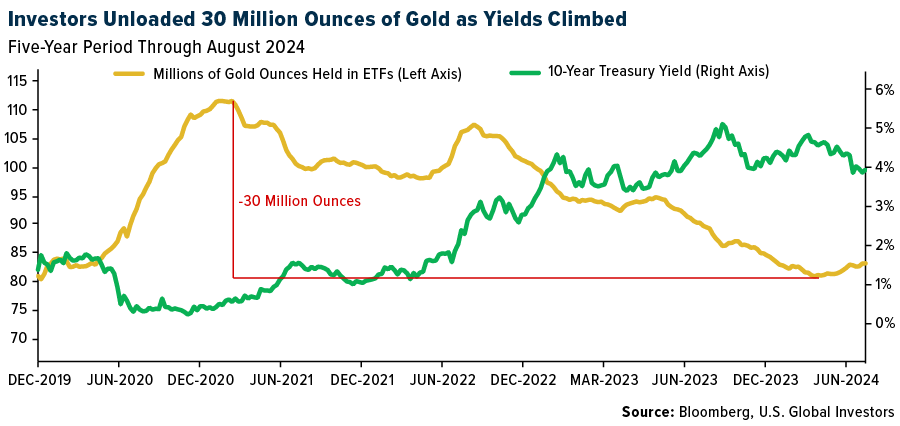

But first, why is this happening? The primary culprit for this disparity, we believe, lies in the impact of interest rates and central banks’ gold-buying spree. The real, inflation-adjusted 10-year Treasury yield rose from a low of around -1.2% in August 2021 to nearly 2.5% in October 2023, and for many investors, particularly those in Western countries, rising yields are a signal to sell non-interest-bearing gold.

That’s exactly what happened. From the end of 2020 to May 2024, exchange-traded funds (ETFs) backed by physical gold shed approximately 30 million ounces, over a quarter of their total holdings, as yield-seeking investors pared back their positions.

What some investors may have overlooked is the long-term potential of the very assets they were letting go of. Gold stocks, unlike the physical metal, offer not just a hedge but also a means of participating in the upside of gold prices. Put another way, when gold prices have gone up, gold stocks have historically tended to rise even more.

Right now, we believe these stocks are offering an attractive combination of low valuations and high potential returns.

A Contrarian Take on Gold Stocks

As contrarians, we understand that the best time to invest is often when sentiment is at its lowest. And sentiment around gold equities is pretty low right now.

But history tells us that this could be the perfect time to buy. As you may be able to tell in the chart above, we’re seeing a reversal of the gold ETF selloff. Since mid-May, investors have added about 2.3 million ounces of gold, according to Bloomberg data; holdings now stand at their highest level since February of this year.

This could be just the beginning. If real interest rates fall substantially, the tide could turn in favor of gold and gold equities.

Why GOAU Could Be a Smart Play for Gold Investors

For investors seeking an efficient way to capitalize on the current opportunity in gold stocks, the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE Arca: GOAU) could be an option worth considering. GOAU provides exposure to companies engaged in the production of precious metals, either through active mining or by generating passive income streams through royalties and production streams.

What sets GOAU apart is its use of a smart beta 2.0 strategy that prioritizes companies with strong fundamentals, including profitability, quality and operational efficiency. Unlike traditional gold-focused ETFs that concentrate primarily on large-cap mining stocks, GOAU selects a diverse group of 28 companies. Those include royalty firms, which have historically provided stable returns with lower risk than explorers and producers.

Why Royalty Companies?

We believe that royalty companies, which represent up to 30% of the ETF’s holdings, are a particularly attractive feature. These firms offer capital to miners in exchange for a portion of future production, mitigating many of the operational risks associated with traditional mining companies. By focusing on royalty and streaming companies, GOAU helps investors manage risk while still benefiting from the upside potential of rising gold prices.

With its distinctive focus on high-quality miners and royalty companies, GOAU offers investors a strategic way to gain exposure to this important asset class. As gold continues its upward trajectory and central banks remain bullish on the metal, GOAU presents a risk-managed approach to capturing the long-term upside in gold stocks.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus by visiting www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Because the fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The fund is non-diversified, meaning it may concentrate more of its assets in a smaller number of issuers than a diversified fund.

The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The fund may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the fund may diverge from that of the index. Because the fund may employ a representative sampling strategy and may also invest in securities that are not included in the index, the fund may experience tracking error to a greater extent than a fund that seeks to replicate an index.

The fund is not actively managed and may be affected by a general decline in market segments related to the index. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Past performance does not guarantee future results.

The U.S. Global GO GOLD and Precious Metal Miners Index uses a robust, dynamic, rules-based smart-factor model to select precious minerals companies that earn over 50% of their aggregate revenue from precious minerals through active (mining or production) or passive (royalties or streams) means. The index uses fundamental screens to identify companies with favorable valuation, profitability, quality and operating efficiency. An investment cannot be made directly in an index.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.

Smart beta 2.0 combines the benefits of passive investing and the advantages of active investing strategies.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. A basis point is one hundredth of 1 percentage point.