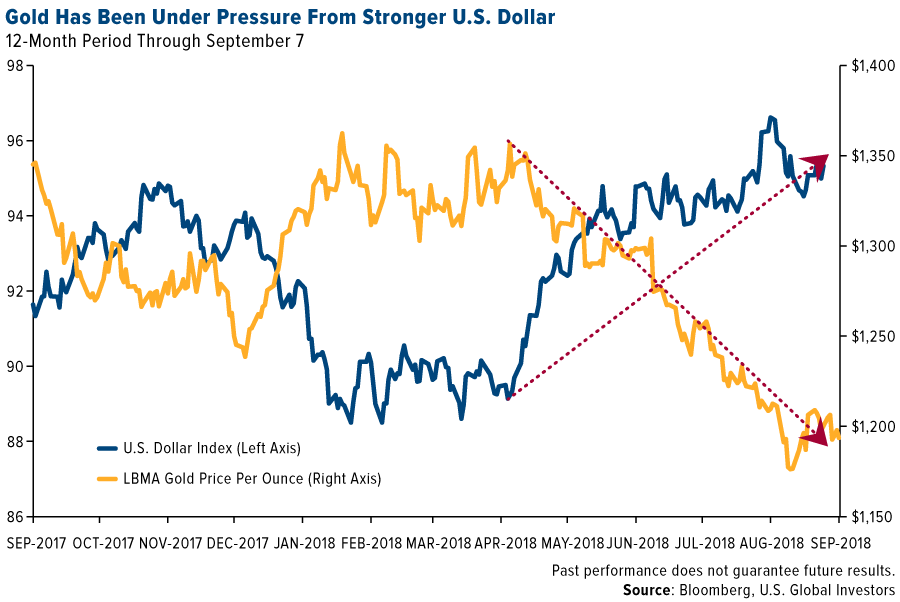

There’s no sugar coating it: Gold had a rough summer. Between May 31 and August 31, the price of the yellow metal lost about $100 per ounce, or 7.7 percent, as the U.S. dollar continued to drift upwards on higher interest rates.

Gold miners felt the pressure as well over the same three-month period. Senior producers, as measured by the NYSE Arca Gold Miners Index, fell 16.5 percent. The MVIS Global Junior Gold Miners Index fared a little better, losing 15.1 percent between May and August.

What this means is that, with valuations now at attractive levels, it might be a good opportunity to add to your gold exposure in anticipation of a potential reversal in the dollar’s relative strength.

In addition, there are some serious economic and financial risks ahead that might favor a larger allocation to gold bullion and gold stocks. This week, Ray Dalio, billionaire co-chairman of Bridgewater Associates, told CNBC that he believes we’re in the “seventh inning” of the economic cycle, adding that it might be a good idea for investors to get “more defensive rather than more aggressive.”

Historically, a defensive investment strategy has included a rotation into gold, bonds and other assets that are uncorrelated to the stock market. In the five-year period between January 2013 and December 2017, gold and precious metal prices had a negative correlation of 0.17 against the S&P 500 Index, according to Morningstar data. This means that when large-cap equity prices zigged, gold prices zagged, helping to lessen the effects of a volatile market.

The Pension Hole for U.S. Cities and States Is the Size of Germany’s Economy

Among the biggest threats to the U.S. economy, we believe, is the latent public pension crisis, which could be much worse than most people realize. The Wall Street Journal reported in July that pension plans nationwide are short some $4 trillion, “an amount that is roughly equal to the output of the world’s fourth-largest economy,” Germany.

Put another way, states and cities across the U.S. now face a funding gap of approximately $4 trillion, a sum that could continue to expand as more workers live longer and draw retirement benefits.

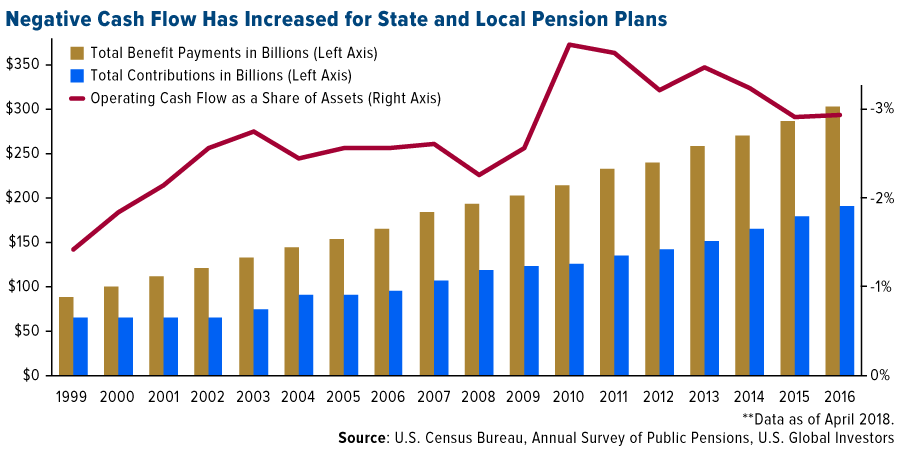

The chart below helps explain how we got to this point. As you can see, the spread between the amount paid out to public workers across the U.S. and the amount municipalities take in every year has been widening steadily over the past couple of decades. Notice that recessions in 2001-2002 and 2008-2009 slowed the contributions but not the benefits.

According to an April 2018 report by the Pew Charitable Trusts, state pension plans paid out $214 billion in benefits in 2016 after taking in only $130 billion in contributions—a difference of $84 billion. This, divided by the total asset value of $2.6 trillion, resulted in a negative operating cash flow of 3.2 percent.

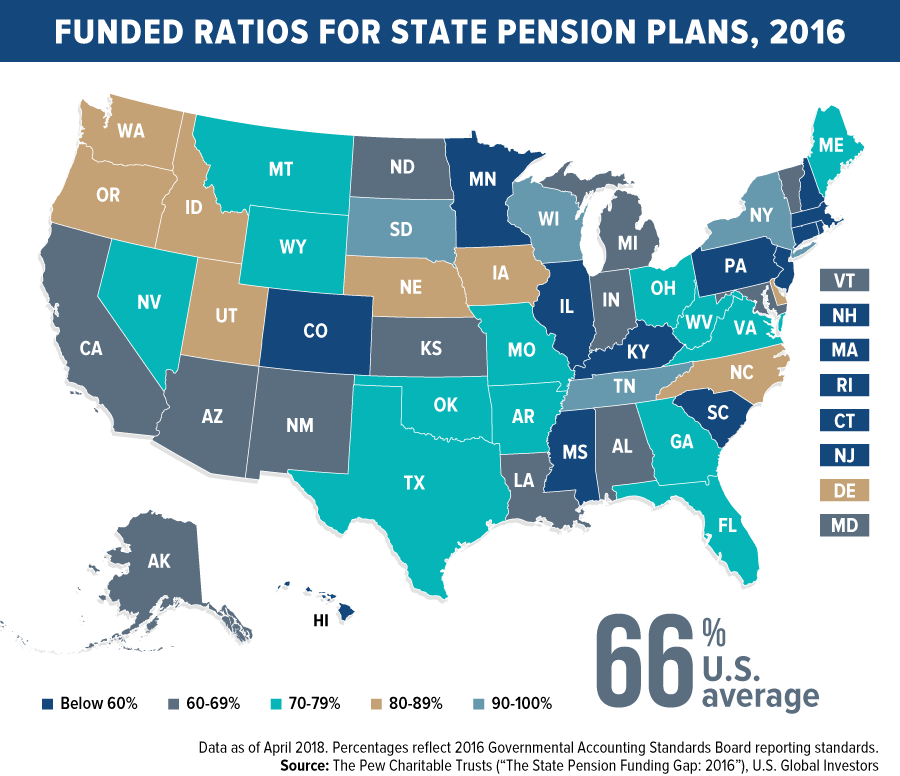

Only four states had more than 90 percent of pension assets funded in 2016, Pew says—Wisconsin (99 percent), South Dakota (97 percent), Tennessee (94 percent) and New York (91 percent). By contrast, as many as 12 states had retirement plans that were less than 60 percent funded.

The state in the worst shape right now is Illinois, according to Moody’s Investors Service. From 2016 to 2017, the Prairie State saw its pension liabilities surge 25 percent to $250 billion, or nearly 21 times the national median of $12 billion. This equates to an unsustainable 601 percent of revenues, an all-time high for any state.

Some analysts aren’t so optimistic a crisis can be averted.

Absent major reforms, “some large states are going to face insolvency” within the next decade, writes Bloomberg’s Aaron Brown. “Cash flow problems three years in the future require chainsaws, not pens. But history does not inspire confidence that warnings will be heeded.” Similarly, ratings firm Fitch is doubtful “funding improvement for many major pensions… may materialize any time soon.” Pension reform is politically unpopular, after all, requiring tax hikes and/or benefit reductions.

Time to Get Defensive?

Only time will tell how the events unfold, of course. But if you believe Ray Dalio that it’s time to get defensive, we think one way to do this is by adding to your portfolio’s exposure to gold. Again, gold has historically had a negative correlation to stocks, and it’s performed well in times in higher inflation.

We believe an attractive way to invest is with our U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), which provides investors access to companies engaged in the production of precious metals either through active or passive means. The fund does not invest directly in gold bullion.

GOAU seeks high-quality, well-managed producers that have a proven track record of sustainable profitability—even when precious metal prices are down.

To learn more, visit the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) homepage where you can see its overview, top holdings, performance and more!

Past performance does not guarantee futures results. Index performance is not indicative of fund performance. To obtain fund performance, click here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Correlation, in the finance and investment industries, is a statistic that measures the degree to which two securities move in relation to each other. Correlations are used in advanced portfolio management, computed as the correlation coefficient, which has a value that must fall between -1 and 1.

Operating cash flow is a measure of the amount of cash generated by a company’s normal business operations. Operating cash flow indicates whether a company can generate sufficient positive cash flow to maintain and grow its operations, or it may require external financing for capital expansion.

The NYSE Arca Gold Miners Index is a rules-based index designed to measure the performance of highly capitalized companies in the gold mining industry. The MVIS Global Junior Gold Miners Index covers the most liquid small-cap companies that are active in the gold/silver mining sector. The S&P 500 is a stock market index that tracks the stocks of 500 large-cap U.S. companies. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.‘s most significant trading partners. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies. The LBMA Gold price is set twice daily at 10:30 and 15:00 in an auction independently operated and administered by ICE Benchmark Administration (IBA). The price is set in US dollars per fine troy ounce.

U.S. Global Investors is not affiliated with Ray Dalio or Bridgewater Associates.