Travelers rejoice: A federal district court judge has struck down the White House’s mask mandates on all mass transit, including commercial flights, buses, trains and more. Domestic airlines swiftly dropped their own mask requirements, meaning passengers can now choose to wear one or not, whether they’re flying on Delta, United, American or Southwest.

We believe this is very welcome news for many passengers and will create a more pleasant flying experience.

According to research from the International Air Transport Association (IATA) airlines’ ventilation systems make the risk of transmitting Covid onboard very low. Most modern aircraft are equipped with high-efficiency particulate air (HEPA) filters, and cabin air is refreshed between 20 and 30 times every hour.

Air Travel Demand Has Already Been Increasing

Even with mask mandates in effect, demand for commercial air travel has been increasing for months.

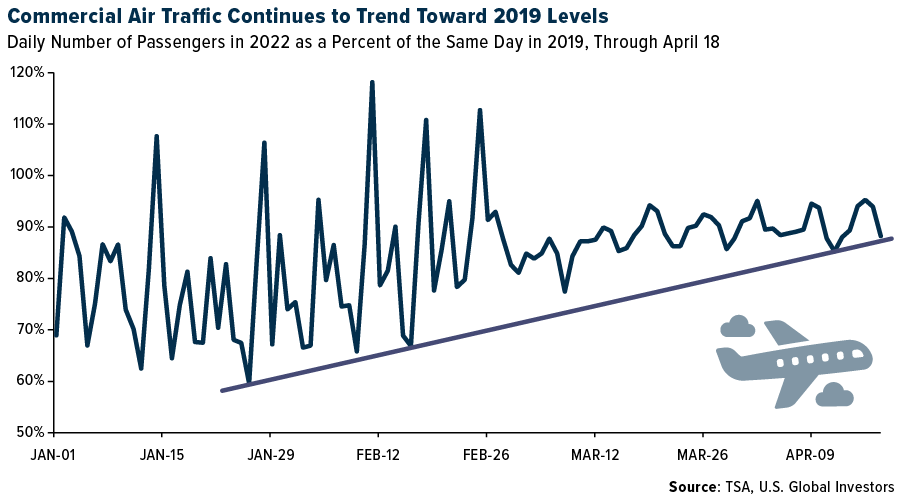

The chart below shows the daily numbers of passengers screened at U.S. airports as a percent of the numbers on the same day in 2019, before the pandemic. We’ve seen a clear upward trend so far this year, especially since Omicron cases began to recede in January.

As an example, on Saturday, April 16, some 1.9 million people boarded commercial jets in the U.S., which is about 95% of the volume seen on the same travel day in 2019.

Again, that’s volume. If we’re talking about money spent, people are spending more on air travel now than they were in 2019, due to inflation. In March, online spending for domestic flights touched $8.8 billion, or 28% higher than pre-pandemic levels, according to Adobe.

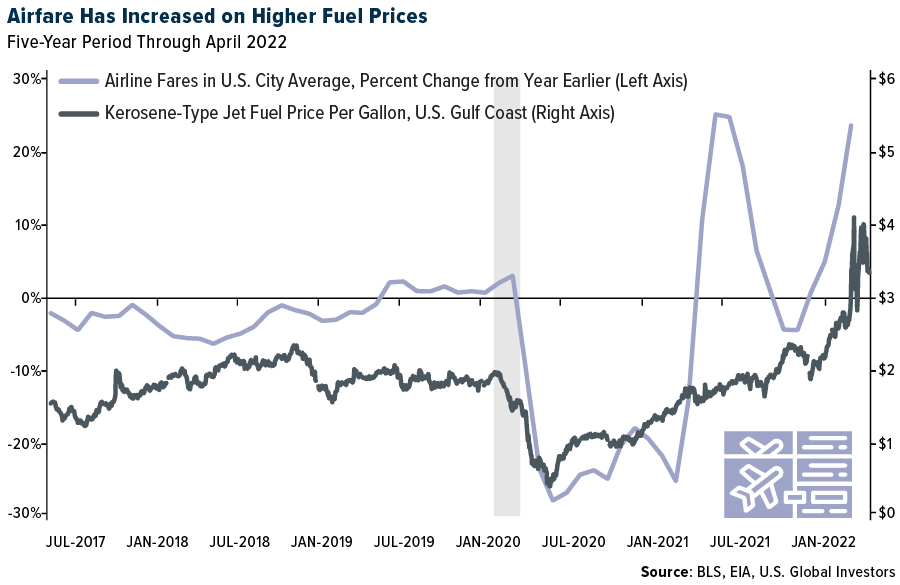

Indeed, airfares are up right now along with fuel prices, but I’m optimistic this won’t have much of an impact on people’s travel decisions. Every flight I’ve been on in the past few months has been packed to capacity. That includes domestic and international.

Want to learn more about airlines and gaining exposure to the industry? Explore the U.S. Global Jets ETF (JETS) by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here. Read it carefully before investing.

Disclosures: Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.