After over two years of strict Covid guidelines and travel bans, border lockdowns and testing requirements, Americans and international travelers alike are getting back to the skies (and roads) more than ever.

Here are three charts showing why we’re confident the airline industry could finally be in “recovery-mode.”

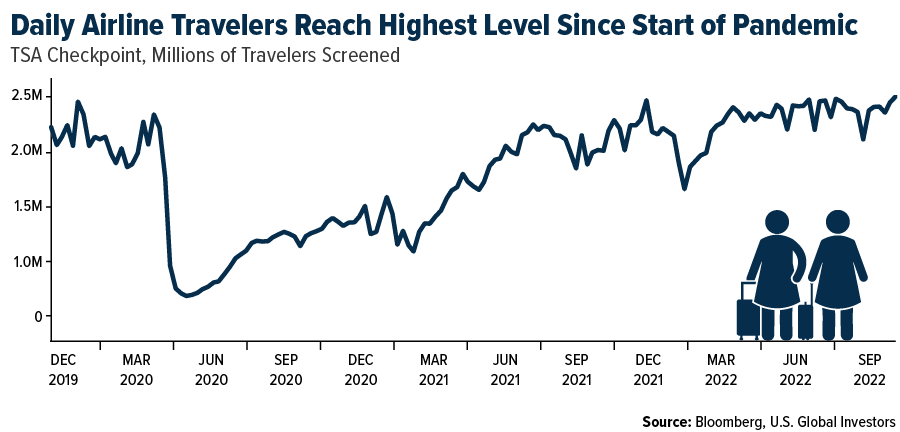

- The Number of Travelers Are Highest Since Before Covid: Data from the Transportation Security Administration (TSA) on Sunday, October 16, shows that 2.496 million travelers passed through security checkpoints in the United States. That is the most since before the pandemic began – a positive sign for the industry as a whole.

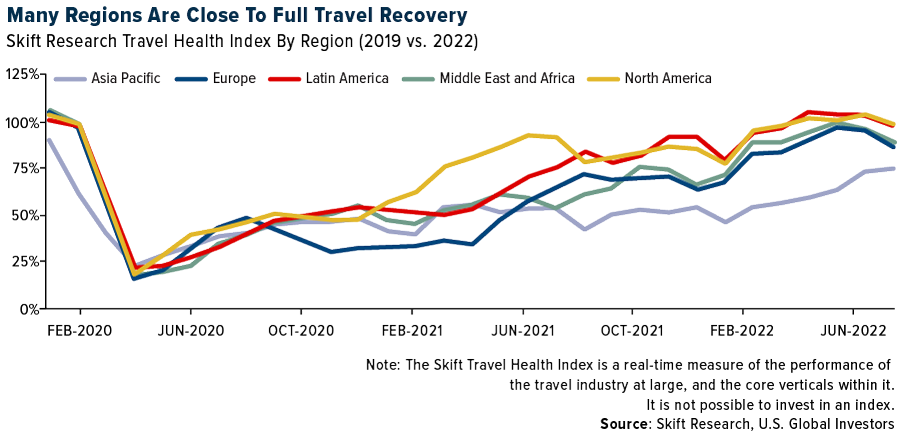

- Travel Recovery Is Underway: According to Skift Research’s State of Travel 2022 report, most regions are close to full travel recovery. Asia Pacific, however, does stand out as a major laggard. Covid-19 vaccines and boosters are losing their importance for world travelers, notes one Bloomberg article. The pullback in restrictions is “an acknowledgement that we’re in a new phase of this pandemic, where things are more stable,” says infectious disease epidemiologist David Dowdy of the Johns Hopkins University School of Medicine.

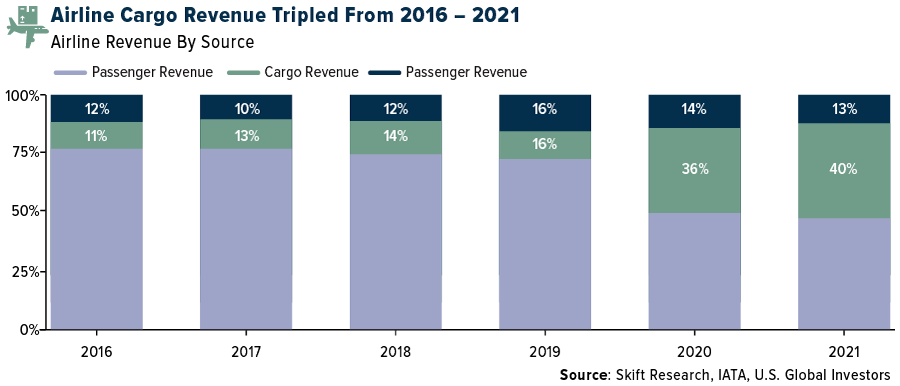

- The Growing Importance of Air Cargo: Passenger airlines aren’t the only ones showing stronger performance. The chart below, also from the Skift Research report, shows that air cargo’s share in total airline revenue more than tripled between 2016 and 2021, increasing from 11% to 40% of total revenue. Although the larger share could partly be due to the depressed state of passenger travel during Covid, it could still be a strong performer moving forward.

The upcoming holiday season will likely be another boost to the industry, as both Thanksgiving and Christmas have historically been the two most traveled holidays, at least in the fourth quarter.

To learn more about one way to invest in the global airline space, learn more about the U.S. Global Jets ETF (NYSE: JETS), by clicking here.

To see the full list of holdings in JETS, click here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. It is not possible to invest in an index.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.