The headlines haven’t been too kind to the travel industry lately. You’ve probably seen the same bearish takes we have—reports of slumping business travel to the U.S., falling international visitor spending and weak demand.

Context is everything, though, and if you dig a little deeper, you’ll see a more nuanced, surprisingly bullish picture. In fact, we think there’s a lot to like about the travel industry right now from an investment standpoint. You just have to know where to look.

Americans Are Still Hitting the Road (and the Skies)

Let’s start with one of the most time-tested indicators of travel health: Memorial Day. According to AAA, an estimated 45.1 million Americans were expected to travel at least 50 miles from home during the past holiday weekend. That’s the highest number ever recorded, breaking a record that’s stood since 2005.

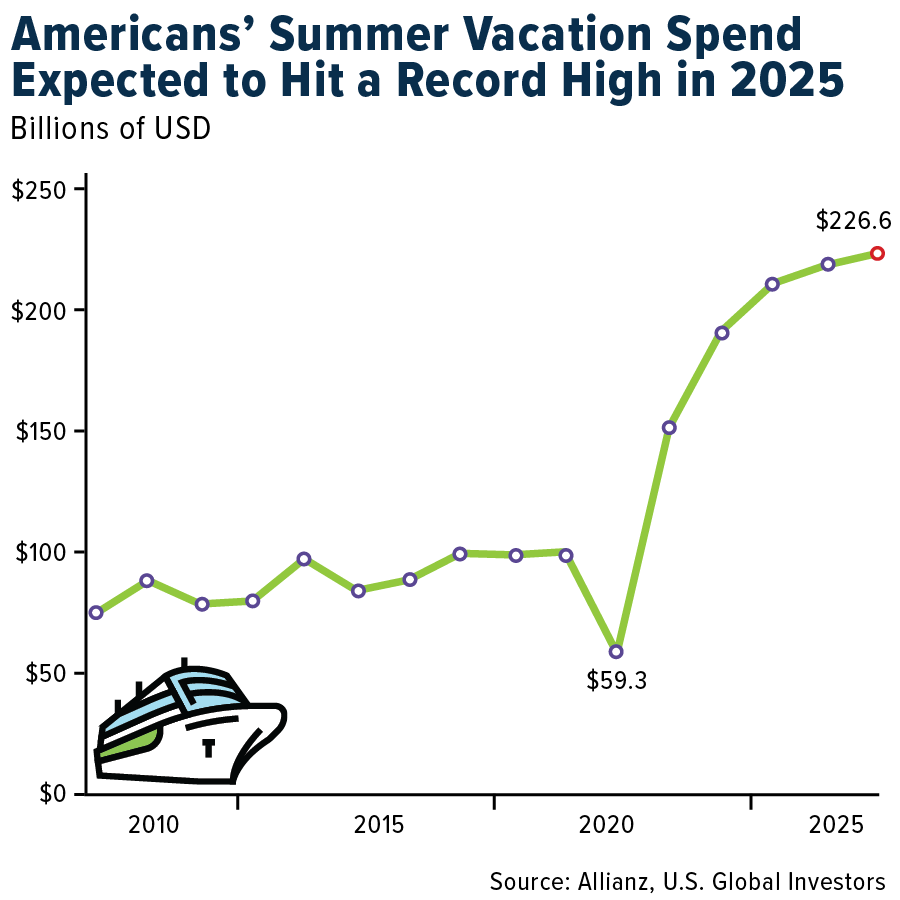

Despite inflationary pressures and economic uncertainty, American consumers continue to prioritize leisure travel. That’s according to Allianz, whose latest survey found that 63% of U.S. households expressed confidence in taking a summer vacation this year, and projected spending is set to hit a record $226.6 billion, with the average household shelling out nearly $2,900 for their getaway.

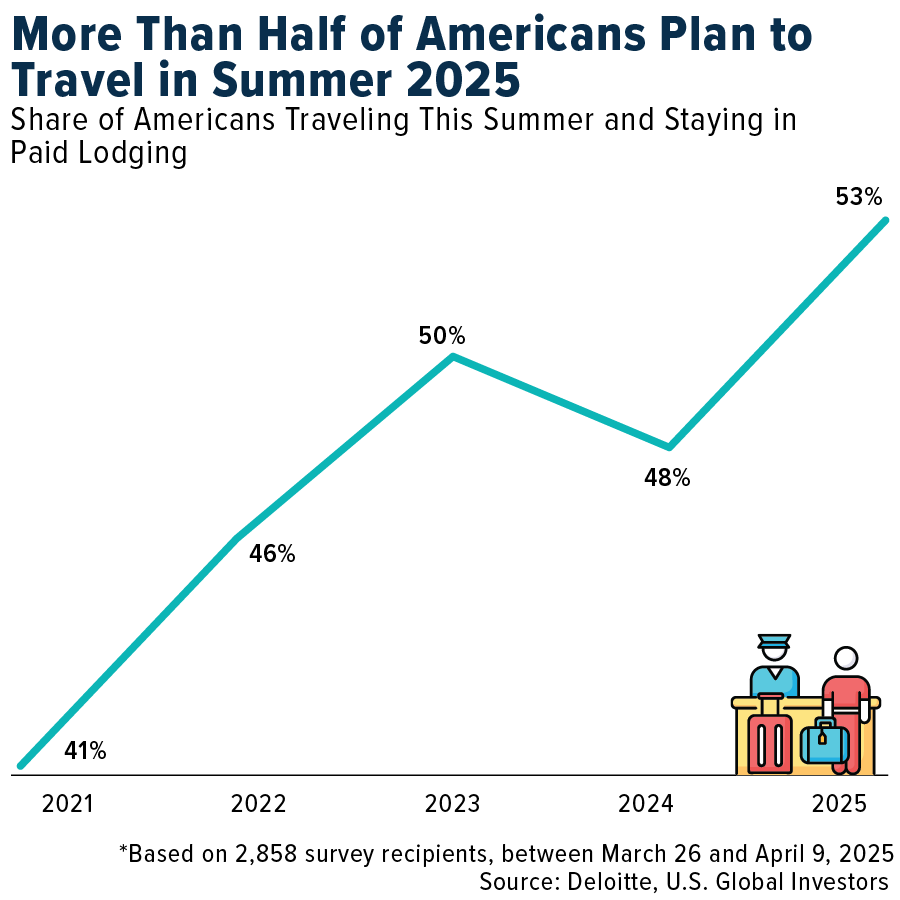

Deloitte also found that more than half of all Americans are planning leisure vacations this summer, with trip frequency on the rise. People may not feel wealthier, but they’re still putting a premium on experiences and making time for family and travel.

Gas Prices Are Down, Confidence Is Up

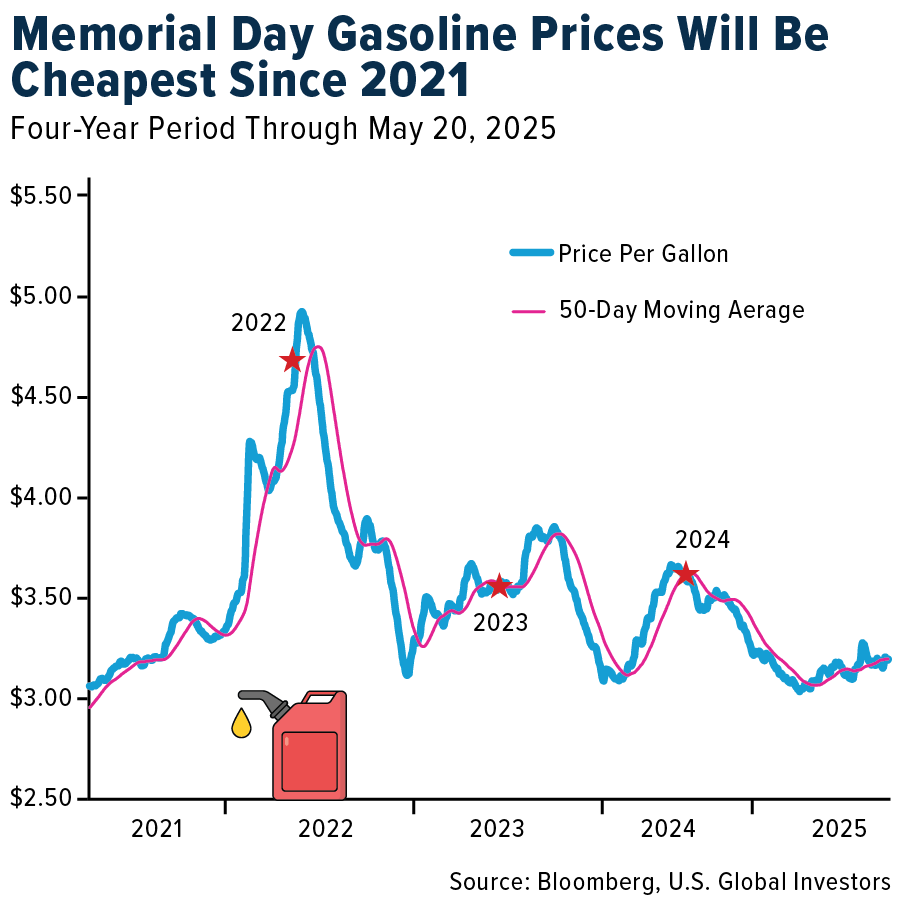

There’s another tailwind worth highlighting: fuel prices. GasBuddy projected a national average of $3.08 per gallon for Memorial Day, the lowest since 2021 and the lowest adjusted for inflation since 2003. Over the course of the summer, prices could even drop below the $3 mark. That’s good news for road trips and domestic leisure, which continues to represent a large portion of overall travel volume.

Air travel is also climbing back. AAA expected nearly 3.61 million air passengers this Memorial Day, a 2% bump from last year and 12% above pre-pandemic levels. Average domestic airfare is also up 2% year-over-year, suggesting steady demand.

Yes, Inbound International Travel Is Weak, but That’s Not the Whole Story

Let’s address the elephant in the room: international inbound travel to the U.S. is underperforming. The World Travel & Tourism Council (WTTC) projects that the U.S. will lose $12.5 billion in international visitor spending in 2025, with total spending expected to fall to just under $169 billion.

Why? Some of it comes down to policy and perception. Reports of detentions and rigorous border checks have created concern among some foreign nationals.

But from an investor’s perspective, this isn’t necessarily as damaging as it sounds. U.S. airlines and travel platforms still generate the majority of international revenue through domestic point-of-sale channels—in other words, Americans booking trips abroad. So while inbound traffic is down, outbound travel remains robust.

European Travel Is on Fire

If you want to see what strong travel demand looks like, look across the Atlantic. Ryanair, the largest airline in Europe by passenger volume, says it’s seeing record demand across its network of 37 countries, with fares up in the mid-teens year-over-year.

CEO Michael O’Leary said, “The whole of Europe seems to be traveling,” and recent earnings support that view. Ryanair’s fare outlook is “far stronger than we had expected,” according to analysts at Bernstein, potentially putting the company on track to replicate the profitability of spring 2023.

Demand for travel hasn’t disappeared. It’s just shifting geographically. Savvy investors can benefit from understanding where the action is moving.

Online Booking Platforms Offer Selective Strength

That brings us to the digital side of the travel business. Booking Holdings—the parent company of Booking.com, Priceline and OpenTable—was recently named IBD’s Stock of the Day after posting 22% earnings per share (EPS) growth and 8% sales growth in Q1. What’s key here is that Booking derives a majority of its revenue from Europe, giving it a natural advantage over U.S.-focused platforms like Expedia and Airbnb, which both flagged weakness in domestic travel.

This divergence is worth watching. As American travel preferences shift toward regional and road-based trips, and international travel increasingly favors Europe over transatlantic routes, platforms with broad, diversified exposure may come out ahead.

To see the top 10 holdings in JETS, click here.

Cruise Lines Are Quietly Sailing Strong

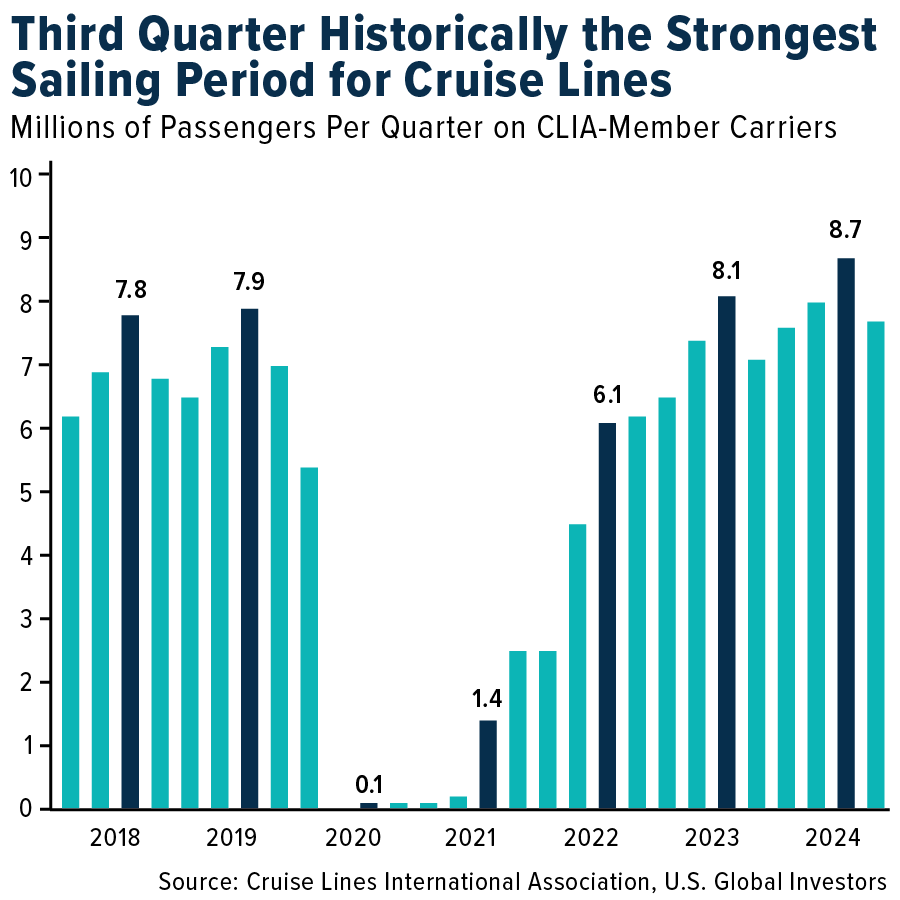

Another area that’s sometimes overlooked, but increasingly important, is cruising. After a few tough years navigating pandemic-era restrictions and capacity limits, cruise lines are finally seeing smooth waters ahead.

Passenger volume has surged, especially in the post-pandemic recovery years. In 2023, cruise lines carried 31.7 million passengers, and that number jumped to 34.6 million in 2024, according to Cruise Lines International Association (CLIA). Forecasts suggest another 9% increase in 2025, reaching 37.7 million passengers, with continued growth projected to hit 42 million by 2028.

The third quarter, typically the high season for cruising, continues to be the industry’s strongest sailing period. In Q3 2024, 8.7 million passengers sailed on CLIA-member cruises, surpassing all previous seasonal peaks. These gains reflect not only pent-up demand but also fleet expansions and strategic deployments of larger, high-capacity ships, especially in popular destinations.

Positioning for Takeoff with JETS

Given the resilient demand for air travel, the question investors should be asking isn’t whether people are traveling, but how to potentially benefit from the global resurgence. One way to gain exposure to this dynamic industry is through the U.S. Global Jets ETF (NYSE: JETS).

JETS offers targeted access to the global airline industry, including major U.S. and international passenger carriers, aircraft manufacturers, airport operators and even airline-focused internet services. Its smart-beta 2.0 strategy ranks companies using key metrics like passenger load factor, cash flow return on invested capital, gross margin and sales yield, helping identify the most efficient players in the travel industry.

The ETF is heavily weighted toward U.S. carriers such as Southwest, Delta, United and American Airlines, but it also includes exposure to fast-growing international markets like India, China and Turkey. We believe this globally diversified portfolio is well-positioned to capture secular growth trends as budget airlines expand and middle-class consumers in emerging markets prioritize travel.

With summer travel heating up and global airline revenues forecast to exceed $1 trillion in 2025, the tailwinds for the airline industry appear strong. If you’re looking for a way to invest in the broader travel comeback, JETS might be your boarding pass.

To learn more, visit www.usglobaletfs.com and explore the JETS ETF today.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Smart Beta 2.0 refers to investment strategies that blend the benefits of passive indexing with elements of active management by using alternative weighting methods based on fundamental and quantitative factors.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.