In a significant turnaround for its aviation sector, Mexico’s air safety rating was upgraded from Category 2 back to Category 1 by the U.S. Department of Transportation (DOT), Mexican President Andrés Manuel López Obrador announced last Friday.

This reinstatement comes after a costly two-year downgrade that restricted Mexico’s airline growth and led to losses exceeding $1 billion for the industry.

For investors watching the aviation space, this upgrade could be a game-changer, offering opportunities for both Mexican airlines and their U.S. joint venture partners.

Robust Growth Amid Challenges

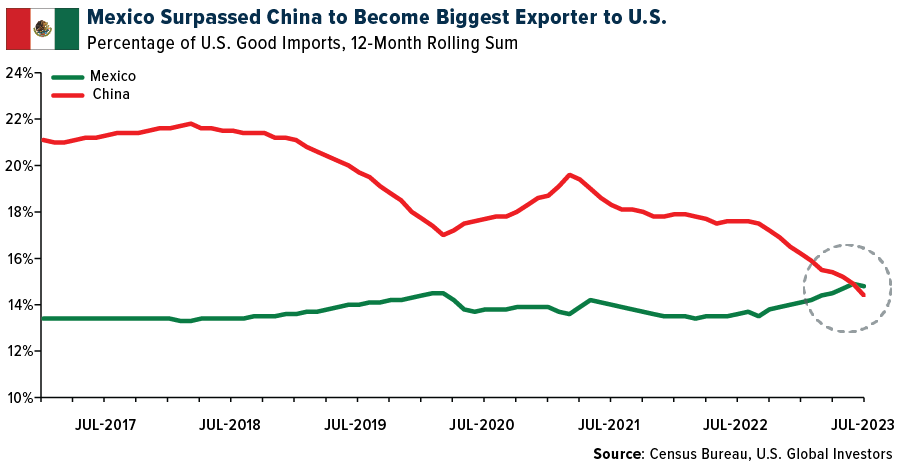

The upgrade to Category 1 is a watershed moment for the Mexican airline industry. This status allows Mexican carriers to add new routes to the U.S., a significant benefit given the Central American country’s recently acquired status as the leading exporter to the U.S., displacing China.

Beyond opening up new routes, the upgrade is a green light for American airlines engaged in joint ventures with Mexican carriers. For example, Volaris, which had been constrained by the Category 2 rating, can now expand its U.S. network, a development that should also make it more attractive to investors.

Delta Air Lines, with its joint venture with Mexican flagship carrier Aeroméxico, is another beneficiary, especially as Aeroméxico plans to go public in the U.S. after delisting from the Mexican stock exchange late last year. Ultra-low-cost carrier (ULCC) Allegiant Air also stands to gain, thanks to its proposed partnership with Viva Aerobus, currently being reviewed by the DOT.

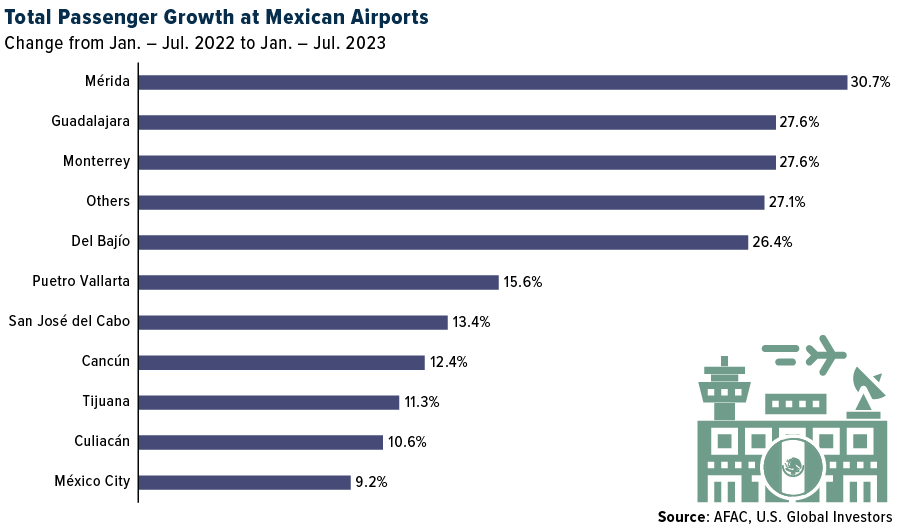

Despite an array of challenges ranging from safety issues to infrastructural vulnerabilities, Mexico’s top three airlines—Aeroméxico, Viva Aerobus and Volaris—registered a collective 16.5% increase in passenger numbers in the first half of 2023 compared to the same period last year.

This growth isn’t that surprising, considering that air travel is increasingly replacing long-distance bus, car and train journeys in Mexico, the number one overseas destination for Americans. Each airline has found its niche—Volaris caters to leisure routes, Aeroméxico targets business travelers and Viva focuses on converting bus passengers to airline customers.

Investment Opportunities in the Airline Sector

Investors have several compelling reasons to look closely at Mexican airlines.

First, the reinstatement to Category 1 status makes these stocks an attractive proposition for market growth and increased revenue. The return to Category 1 has already had an impact, with U.S.-traded shares of Volaris closing last Friday’s session up more than 12% following the announcement, its best day since January.

Even before the status upgrade, Aeroméxico was experiencing strong demand in European markets, capitalizing on its unique position as Mexico’s only long-haul operator. According to data from the Centre for Aviation (CAPA) and the Official Airline Guide (OAG), 65% of the airline’s available seat kilometers (ASKs) are from international operations.

For those considering diversified options, American partners of these Mexican carriers also present investment opportunities. With global air traffic nearly returning to pre-pandemic levels and Latin American airlines experiencing a more than 25% increase in traffic between July 2022 and July 2023, the industry is set for an upswing.

The upgrade of Mexico’s air safety rating from Category 2 to Category 1 represents a pivotal moment for the country’s commercial aviation sector. This development not only fosters growth for Mexican airlines but also provides a favorable climate for investors.

With Mexican airlines expanding domestically and entering into profitable partnerships with U.S. carriers, the industry offers what I believe is a compelling investment landscape.

To see the full list of holdings in the U.S. Global Jets ETF (JETS), click here.

To download a copy of the JETS prospectus, fact sheet and investment case, click here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.