Economic concerns have impacted global markets, with the price of Brent oil price plunging below $80 per barrel. Historically, declines in oil prices have been a boon for the global airlines industry, reducing one of its largest operational costs: fuel. This presents a potentially attractive opportunity for investors, particularly with the U.S. Global Jets ETF (NYSE: JETS).

The Opportunity in Lower Oil Prices

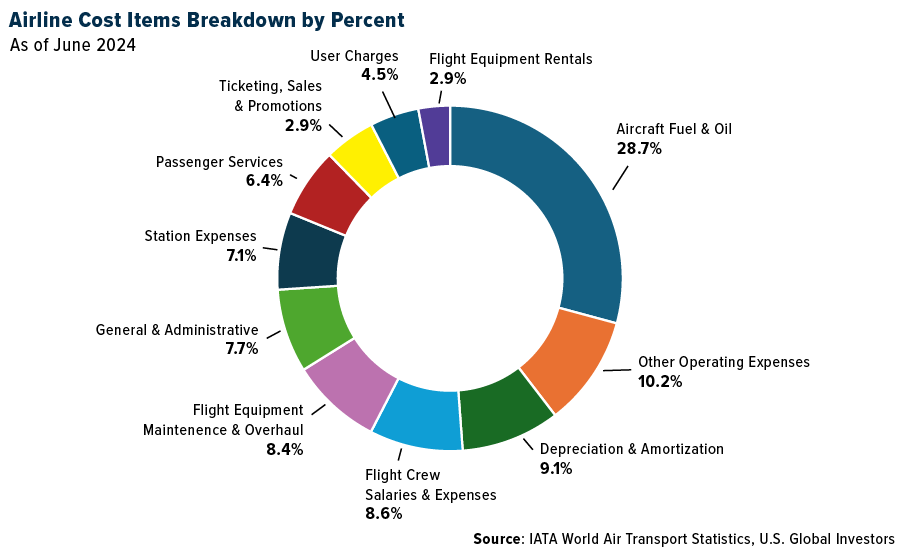

Fuel expenses typically represent a substantial portion of an airline’s total costs, often accounting for 20% to 30%. According to the International Air Transport Association (IATA), fuel and oil represented 28.7% of expenses, on the higher end of the scale, as of June 2024.

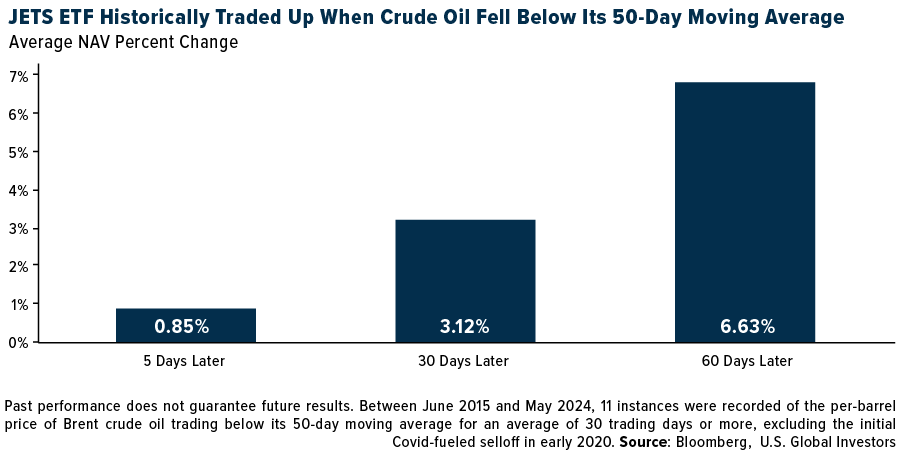

Our research shows that lower oil prices have historically been a windfall for airline stocks. Between June 2015 and May 2024, we counted 11 instances when the per-barrel price of Brent crude traded below its 50-day moving average for at least 30 consecutive trading days. (We excluded the Covid-fueled selloff in Spring 2020, which would skew the data.) When this occurred, shares of JETS often saw gains in the days and weeks ahead. The ETF rose 0.85% on average within five days of oil falling below its moving average, 3.12% within 30 days, and an impressive 6.63% over 60 trading days.

To see JETS’ standardized performance and gross expenses, click here.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end please visit www.usglobaletfs.com.

With flight demand continuing to hover near all-time highs, airlines stand to benefit from the recent reduction in jet fuel costs. This is good news for the global economy, as the aviation industry supports around 4.1% of the world’s gross domestic product (GDP), according to the Air Transport Action Group (ATAG).

Embracing a Sustainable Future

Beyond the immediate financial benefits of lower fuel costs, the airline industry is also making strides toward a more sustainable future. United Airlines recently announced its purchase of sustainable aviation fuel (SAF) for use at major airports, including Chicago’s O’Hare International Airport. SAF, derived from renewable materials like used cooking oil and animal fat waste, offers a cleaner alternative to conventional jet fuel, reducing greenhouse gas emissions by up to 80% over the fuel’s life cycle.

The U.S. Energy Information Administration (EIA) estimates we’ll see a big increase in SAF production capacity starting this year. We believe this could end up playing a crucial role in the industry’s evolution going forward. By tracking the U.S. Global Jets Index (JETSX), JETS offers exposure not only to commercial airlines but also to aircraft manufacturers and airport operators, some of which are pioneering these advancements.

Smart Beta 2.0: A Modern Approach to Investing

The U.S. Global Jets ETF (JETS) is designed to provide investors with comprehensive exposure to the global airline industry. Using a smart beta 2.0 strategy, the JETS ETF combines the benefits of passive investment with the advantages of active management. This dynamic approach helps identify the most efficient carriers and industry players, positioning the ETF to capitalize on both market trends and individual stock performance.

With Brent oil prices declining and the potential for reduced operational costs, now may be an opportune time to consider JETS. As always, we encourage investors to conduct their own research and consult with financial advisors to ensure that their investments align with their financial goals and risk tolerance.

Explore the JETS ETF, request information and more by clicking here!

Past performance does not guarantee future results.

Please click here for standardized performance.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.

The NYSE Arca Airline Index is an equal-dollar weighted index of the most highly capitalized companies in the airline industry.