In its outlook for 2018, Thomson Reuters GFMS analysts see gold prices rising to $1,500 an ounce sometime this year on inflation fears. This would put gold at a level unseen since April 2013.

According to Thomson Reuters, the price appreciation could be driven by “concerns that the United States may pull out of NAFTA,” or the North American Free Trade Agreement. NAFTA, of course, is the trade pact the U.S. shares with Canada and Mexico, its number two and three largest trading partners.

The Trump administration has already imposed tariffs on Canadian softwood lumber, and more recently it set steep tariffs on imported washing machines and solar panels—all of which is inflationary. The same thing goes for the recently-passed tax overhaul, which has prompted some companies such as Walmart and Starbucks to raise their minimum wage.

But if the administration were to withdraw the U.S. from NAFTA, as President Donald Trump has hinted at numerous times, prices on consumer goods and services could become destabilized and begin to surge.

In anticipation of this, investors might want to consider adding to their gold exposure, which has a history of performing well in times of rising inflation.

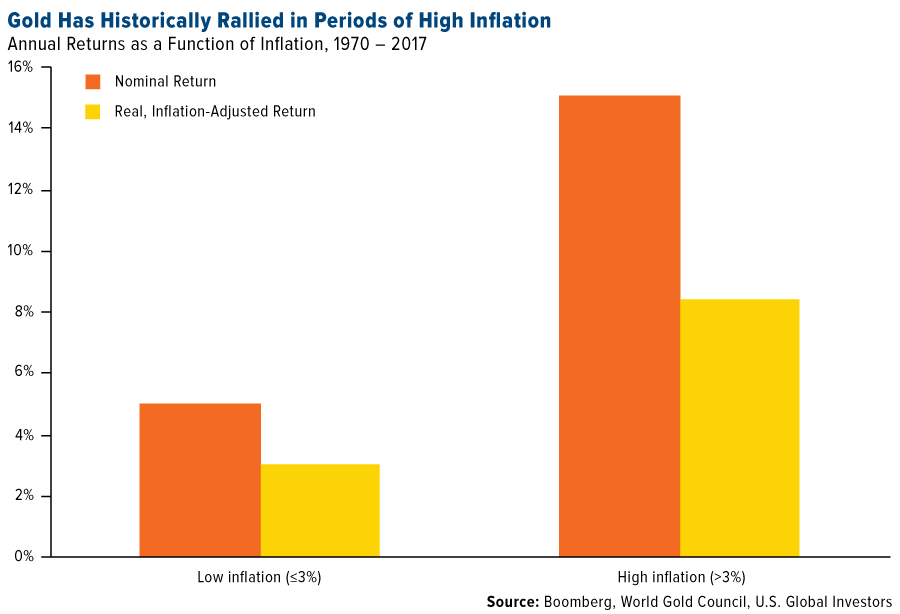

Gold Has Helped Preserve and Grow Capital in Times of Rising Inflation

The chart below, courtesy of the World Gold Council (WGC), shows that annual gold returns were around 15 percent on average in years when inflation was 3 percent or higher year-over-year, between 1970 and 2017. In real, or inflation-adjusted, terms, returns were closer to 8 percent. This is still higher, though, than average returns in years when inflation was lower.

According to the WGC, “gold returns have outpaced the U.S. consumer price index (CPI) over the long run, due to its many sources of demand. Gold has not just preserved capital, it has helped it grow.”

Having a 5 to 10 percent weighting in gold and gold stocks, then, could help investors minimize their losses in other asset classes.

Dollar Weakness Also Driving Gold Prices

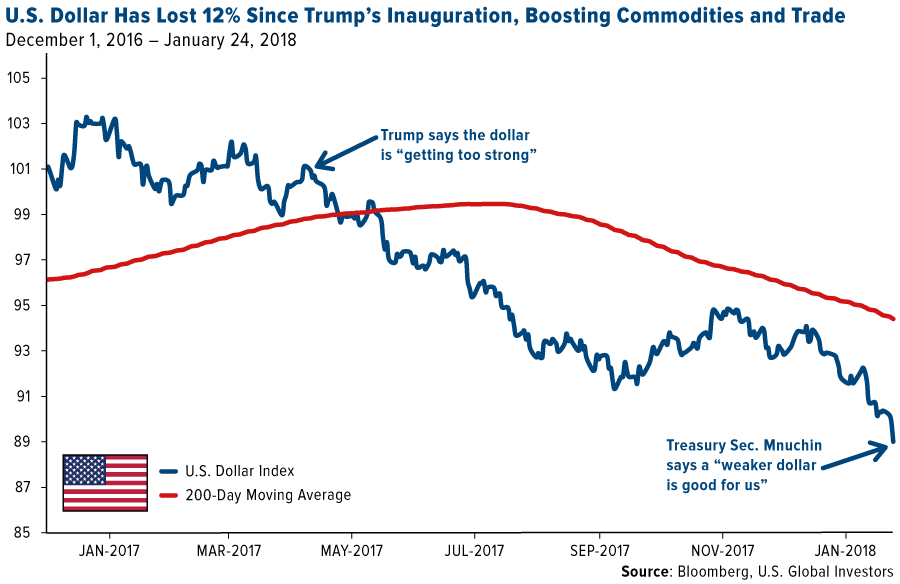

Tariffs and higher wages aren’t the only Fear Trade factors moving gold prices right now. A weaker U.S. dollar, relative to other global currencies, deserves a lot of the credit as well.

For the past several weeks, the greenback has plunged in value, dipping more than 1 percent last Wednesday alone—its biggest one-day pullback in 10 months. This came following Treasury Secretary Steven Mnuchin’s comment at the World Economic Forum in Davos, Switzerland, that a weaker dollar “is good for us as it’s related to trade and opportunities.” The greenback similarly tanked back in April 2017 when President Trump said the dollar is “getting too strong.” Soon after, it fell below its 200-day moving average.

Last Thursday, however, Trump walked back Mnuchin’s (and his own) comment, telling CNBC that the dollar “is going to get stronger and stronger, and ultimately I want to see a strong dollar.”

In any case, the year-long decline has been a short-term tailwind for gold, which is priced in U.S. dollars and, therefore, becomes less expensive for foreign buyers when it sinks. We believe the greenback peaked last January and that we could see further depreciation.

How to Play the Rally

One of the best ways to gain exposure to the gold space, we believe, is with the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). The fund provides access to companies engaged in the production of precious metals not only through active means—mining, for instance—but passive means as well. That includes gold and precious metal royalty companies, which provide upfront cash to producers to develop a project. In return, they receive royalties or rights to a “stream,” an agreed-upon amount of gold, silver or other precious metal at a lower-than-market price.

We believe this is a superior business model, which is why 30 percent of GOAU is weighted in gold royalty names. These companies have exposure to precious metals but have managed to remain profitable even when prices are down. Because they’re not directly responsible for building and maintaining mines and other costly infrastructure, huge operating expenses can be avoided. They also hold highly diversified portfolios of mines and other assets, which helps mitigate concentration risk in the event that one of the properties stops producing. As a result, royalty companies have enjoyed a much lower breakeven cost than traditional miners.

Compared to many other companies in the mining space, royalty companies have tended to be better allocators of capital, taking on very little debt and deploying cash reserves only at the most opportune times.

Interested in learning more? Explore the U.S. Global GO GOLD and Precious Metals Miners ETF (GOAU) today!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The U.S. Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies.

The consumer price index (CPI) is an index of the variation in prices paid by typical consumers for retail goods and other items.