SAN ANTONIO—January XX, 2020—U.S. Global Investors, Inc. (Nasdaq: GROW) is thrilled to announce that its gold equities ETF, the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), is now available for investors to trade on three additional platforms.

GOAU, which had a phenomenal 2019, returning 53.37 percent, was recently approved by Raymond James, Oppenheimer & Co. and Janney Montgomery Scott, making the ETF accessible to even more investors.

“We couldn’t be more pleased with how well GOAU has performed since its debut more than two years ago,” comments Frank Holmes, CEO and chief investment officer of U.S. Global Investors. “It’s done exactly what we said it would, and we’re excited for more investors to discover it now that it’s been approved for trading on the three platforms.”

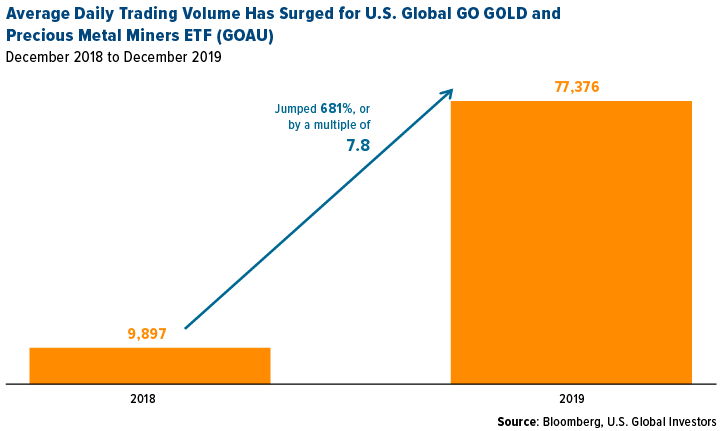

Besides delivering stellar performance, GOAU has seen its trading volume surge over the past 12 months. Between December 2018 and December 2019, average daily trading volume jumped 681 percent, or by a multiple of 7.8, from 9,897 shares to as many as 77,376 shares.

Debuting in June 2017, the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) is a quant-based gold equities ETF that puts special emphasis on royalty and streaming companies, which provide upfront capital to producers and explorers in exchange for payments on future output.

To learn more about GOAU, click here.

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 40 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides money management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Please click here to see the GOAU prospectus.

| Total Annualized Returns as of 12/31/2019 | |||||

|---|---|---|---|---|---|

| Fund | One-Year | Five-Year | Ten-Year | Since Inception | Gross Expense Ratio |

| U.S. Global GO GOLD and Precious Metal Miners ETF NAV | 53.37% | n/a | n/a | 16.44% (6/27/2017) |

0.60% |

| U.S. Global GO GOLD and Precious Metal Miners ETF Share Price | 54.14% | n/a | n/a | 16.71% (6/27/2017) | 0.60% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. For performance data current to the most recent month-end please visit www.usglobaletfs.com.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Because the fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The fund is non-diversified, meaning it may concentrate more of its assets in a smaller number of issuers than a diversified fund. The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The fund may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the fund may diverge from that of the index. Because the fund may employ a representative sampling strategy and may also invest in securities that are not included in the index, the fund may experience tracking error to a greater extent than a fund that seeks to replicate an index. The fund is not actively managed and may be affected by a general decline in market segments related to the index. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

GOAU is distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.