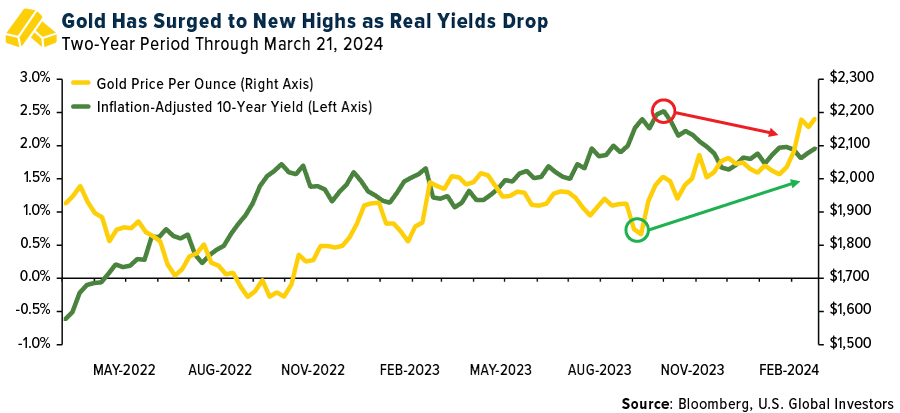

Gold staged a blinding comeback last week, surging to fresh all-time highs above $2,200 an ounce. The rally, which has added around 10% to gold’s value since mid-February, caught many market watchers off-guard. But for those of us who’ve stuck with the yellow metal through its ups and downs, the price action is the vindicating result of several powerful forces aligning in bullion’s favor.

At the heart of gold’s resurgence is the Federal Reserve’s signal that it may be ready to throw in the towel. Fed Chair Jerome Powell has made it clear that the central bank is on course to cut rates as many as three times in 2024, fueling hopes that the tight monetary policy of the past 18 months is nearing an end.

With rate cuts on the horizon, real yields have cooled, increasing the relative attractiveness of non-interest-bearing gold.

Traders have wasted little time pricing in the Fed’s dovish stance. Futures markets now see a 72% chance of a rate cut as soon as June, up from 65% before the Fed meeting. Against this backdrop, gold’s surge is, I believe, textbook price action.

Central Banks’ Insatiable Appetite for Gold Fueling the Rally

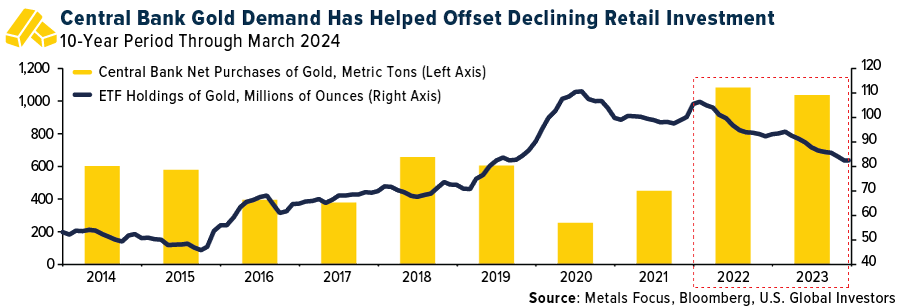

There’s more to the rally than just lower rates and a weaker U.S. dollar. As many people are aware, central bank demand for gold has been a powerful driver as more and more developing countries join the de-dollarization movement in response to Western sanctions on Russia.

China has led the charge here, consistently adding large amounts of gold to its reserves for the past 16 months straight. Overall central bank buying reached record highs in 2022 and has shown no signs of slowing, helping to offset the selling pressure caused by gold-backed ETFs.

Gaining Exposure with GOAU

We believe an attractive way to gain exposure to gold in your portfolio is with the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). GOAU provides investors access to companies engaged in the production of precious metals either through active (mining or production) or passive (owing royalties or production streams) means. The fund seeks high-quality, well-managed producers that have a proven track record of sustainable profitability whether gold is trading near all-time highs or not.

To learn more, visit the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) homepage where you can see its overview, top holdings, performance and more!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political, or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Fund holdings and allocations are subject to change at any time. Click here to view fund holdings for GOAU.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.