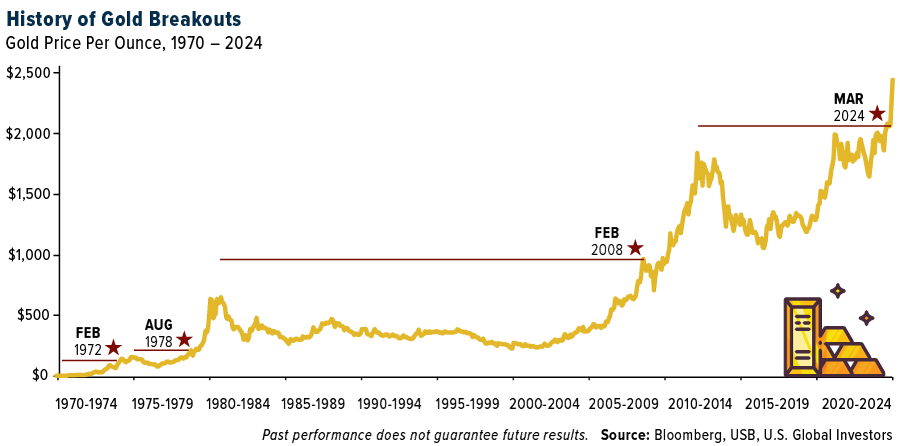

Gold hit a fresh all-time high of $2,432 per ounce on Friday, April 12, marking what we see as one of the great gold breakouts since the end of Bretton Woods. The yellow metal’s appeal as a hedge against uncertainty, coupled with steady monthly purchases by central banks, has not merely raised the price floor but could help the asset achieve new highs in the coming weeks and months.

Preserving Purchasing Power Across Borders

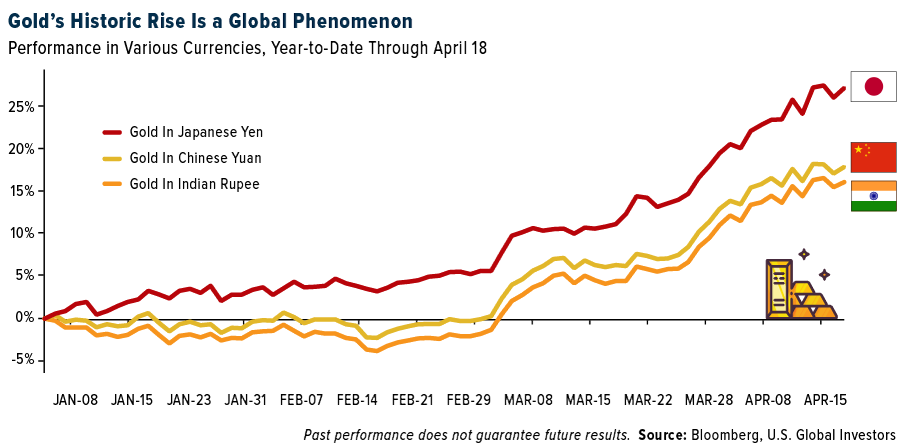

Gold’s recent surge isn’t just a U.S. dollar story. The precious metal has also made historic breakouts in various currencies around the world, from the Japanese yen to the Chinese yuan and Indian rupee. This global phenomenon underscores the broad appeal of gold as a store of value and a means of preserving purchasing power.

Chinese retail investors are leading a significant influx into the country’s gold-backed ETFs. In March alone, Chinese gold ETFs saw an impressive inflow of RMB1.2 billion ($164 million), marking the fourth straight month of positive flows, according to the World Gold Council (WGC). The investing spree propelled total AUM in gold ETFs to a staggering RMB35 billion ($5 billion) by month’s end.

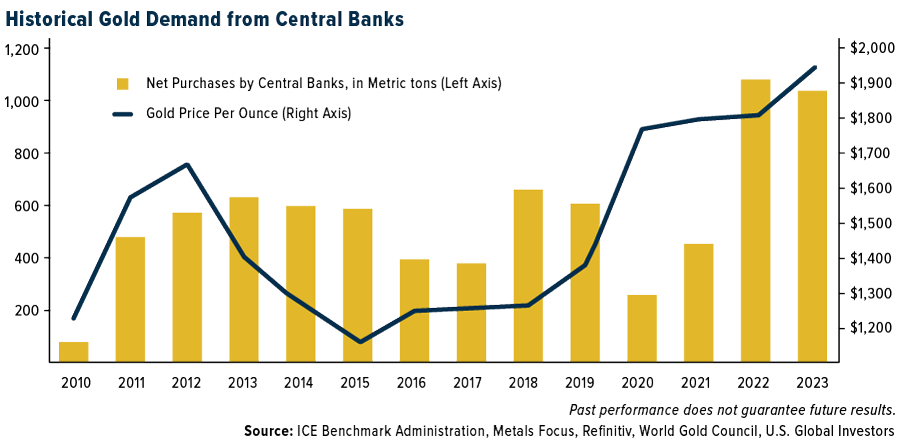

Historic Central Bank Demand Reshaping the Gold Market

Gold’s bull market can be attributed to several factors, including negative real interest rates, expanding government debt and the ongoing de-dollarization efforts by BRICS countries such as China and Russia. (BRICS stands for Brazil, Russia, India, China and South Africa.) As central banks continue to print money and governments run massive deficits, investors have increasingly turned to gold as a store of value.

One of the most striking developments over the past several years has been the historic demand from central banks. These institutions have been accumulating gold at an unprecedented pace as they seek to reduce their dependence on the U.S. dollar and create an alternative global reserve currency.

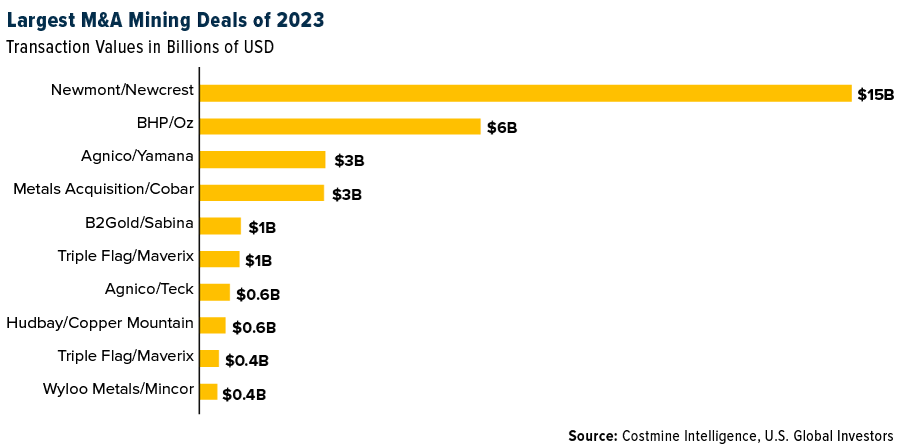

Consolidation in the Gold Mining Industry

We’re seeing an incredible amount of merger and acquisition (M&A) activity in the gold mining sector. Gold producers are struggling to grow their reserves organically due to the lack of new, large discoveries and declining reserves at existing mines. As a result, many companies are turning to M&A as a way to expand their production and take advantage of the bullish gold market. Below are the top 10 largest mining deals of 2023, starting with Newmont’s acquisition of Newcrest for approximately $15 billion.

This consolidation is creating some exciting opportunities for investors. By owning shares in well-managed gold mining companies, investors can gain leverage to the rising gold price while also benefiting from the potential upside of successful M&A transactions.

Diversifying Portfolios with Gold and Gold-Related Investments

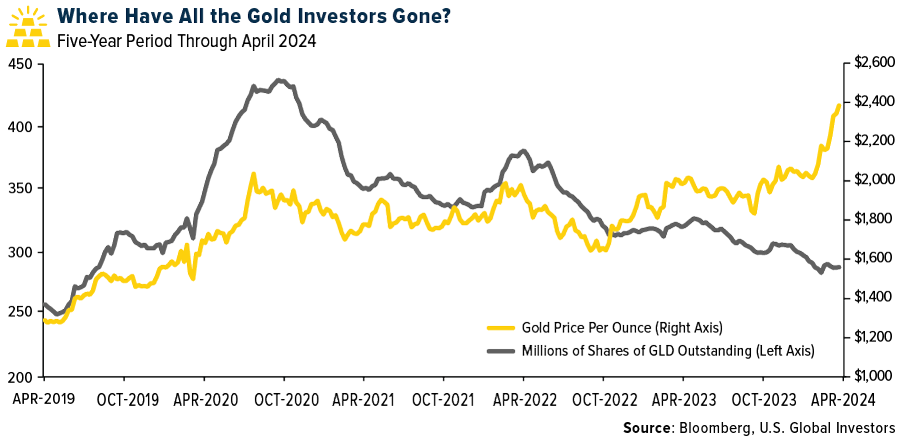

Higher prices have not necessarily resulted in greater investment in the U.S., and we believe investors may be leaving an opportunity on the table. Even as the price of gold has crept up over the past four years, the number of shares outstanding in the SPDR Gold Shares ETF (GLD) has declined, indicating demand has a lot of catching up to do.

For investors seeking exposure to gold without the risks associated with individual mining stocks, gold royalty and streaming companies offer an attractive option. These companies provide upfront capital to gold miners in exchange for a percentage of future gold production or revenue. This allows royalty and streaming companies to generate high margins and strong cash flows with minimal operational risk.

GOAU and Gold Royalty Companies

We believe this is a superior business model, which is our U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) focuses on gold royalty names. These companies have exposure to precious metals but have generally managed to remain profitable even when prices are down, due to strong balance sheets and attractive portfolios of active mines.

Think of gold royalty companies as specialized financiers. They produce the upfront capital for cash-strapped explorers in exchange for either royalties on future sales or a portion of the metal. Because they’re not directly responsible for building and maintaining mines and other costly infrastructure, royalty firms can avoid huge operating expenses. They also hold highly diversified portfolios of mines and other assets, which helps mitigate concentration risk in the event that one of the properties stops producing.

Compared to many other companies in the mining space, royalty companies have tended to be better allocators of capital, taking on very little debt and deploying cash reserves at the most opportune times.

To learn more about the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), click the link below!

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU here. Read it carefully before investing.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political, or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Fund holdings and allocations are subject to change at any time. Click here to view fund holdings for GOAU.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.