It’s the biggest company you’ve never heard of—until last week, that is. Evergrande Group, the “too big to fail” Chinese property developer, rattled markets last Monday when it missed interest payments to at least two of its lenders. This gave more than a few investors flashbacks to Lehman Brothers’ demise in 2008, which helped trigger the global financial crisis.

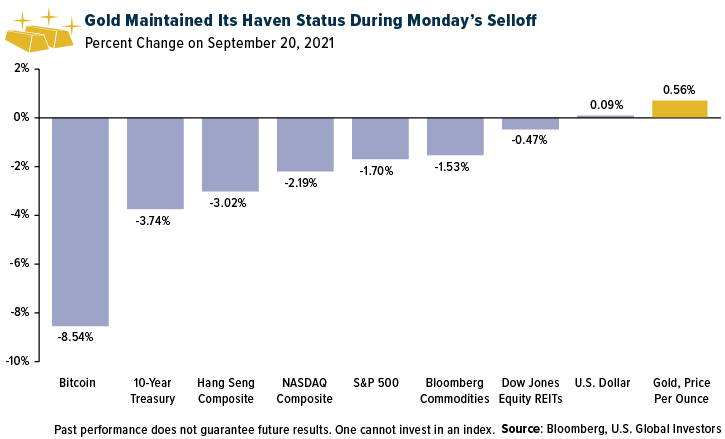

The selloff spread to U.S. markets, and we were pleased to see that gold maintained its haven status. The yellow metal ended the day slightly up more than half a percent, passing an important “stress test” of its investment case in the age of Bitcoin.

The world’s biggest cryptocurrency, believed by many to be “digital gold,” plunged 8.5% on Monday as investors dumped riskier assets.

Bitcoin dipped further last week after the Chinese government banned all crypto transactions and crypto mining, prompting many to speculate that the People’s Bank of China (PBOC) is preparing to issue its own CBDC, or central bank digital currency.

Gold Looks Attractive as Contagion Fears Mount

It’s hard to believe that President Xi will do nothing. Evergrande may not be a household name in the U.S., but it’s China’s second largest real estate company, with nearly 800 projects in 234 cities. It also offers financial products, invests in electric vehicles and is even building a theme park on an artificial island off the province of Hainan.

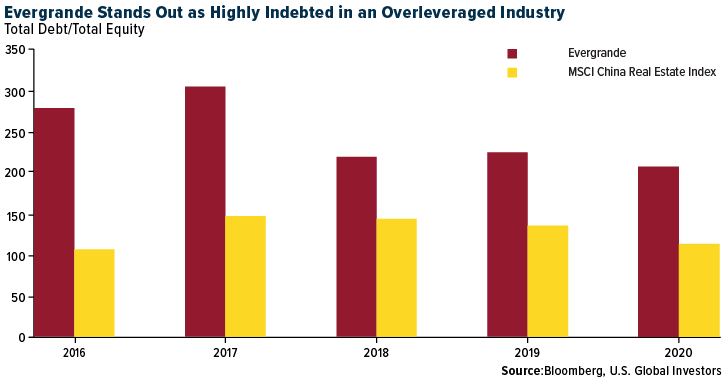

This growth didn’t happen organically, though, and today Evergrande is believed to be the world’s most indebted developer, saddled with more than $300 billion in total liabilities. In November 2020, the Financial Times wrote that the Fortune 500 company “has enough land to house the entire population of Portugal and more debt than New Zealand.” At the end of last year, it had roughly twice as much debt as equity, putting it in a class well above other Chinese real estate firms.

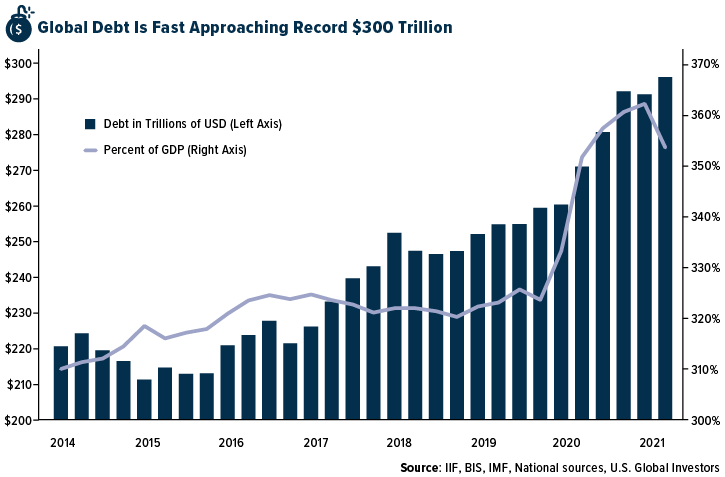

As “eye-popping” as Evergrande’s debt load is, it’s a “small drop in the ocean of debt that the world is swimming in,” CLSA’s Damian Kestel wrote in a note to clients. Total global debt in the second quarter stood at just under $300 trillion, a new record, according to the Institute of International Finance’s (IFF) most recent Global Debt Monitor.

“The bigger they come, the harder they fall,” as the saying goes. If Evergrande were allowed to fail without any governmental intervention, it could spark a credit crisis that would make 2007-2008 look tame by comparison.

Against this backdrop, gold looks potentially attractive as a store of value. We have always recommended a 10% weighting in gold, with 5% in bullion and 5% in gold mining stocks and ETFs.

How to Gain Exposure?

One way investors can consider gaining exposure to gold is with the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) . GOAU provides investors access to companies engaged in the production of precious metals either through active (mining or production) or passive (owning royalties or production streams) means.

Click here to download the GOAU fact sheet!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a summary prospectus for GOAU here. Read it carefully before investing.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS and GOAU.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Bloomberg Commodity Index (BCOM) is calculated on an excess return basis and reflects commodity futures price movements. The Dow Jones Equity All REIT Index is designed to measure all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as equity REITs. The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The MSCI China Real Estate Index is designed to capture the large and mid-cap segments of the China equity markets.